为各行业用户定制软硬件一体数字化管理解决方案

从现场部署到实施上线,深入业务场景,助力用户实现全方位数字化管理

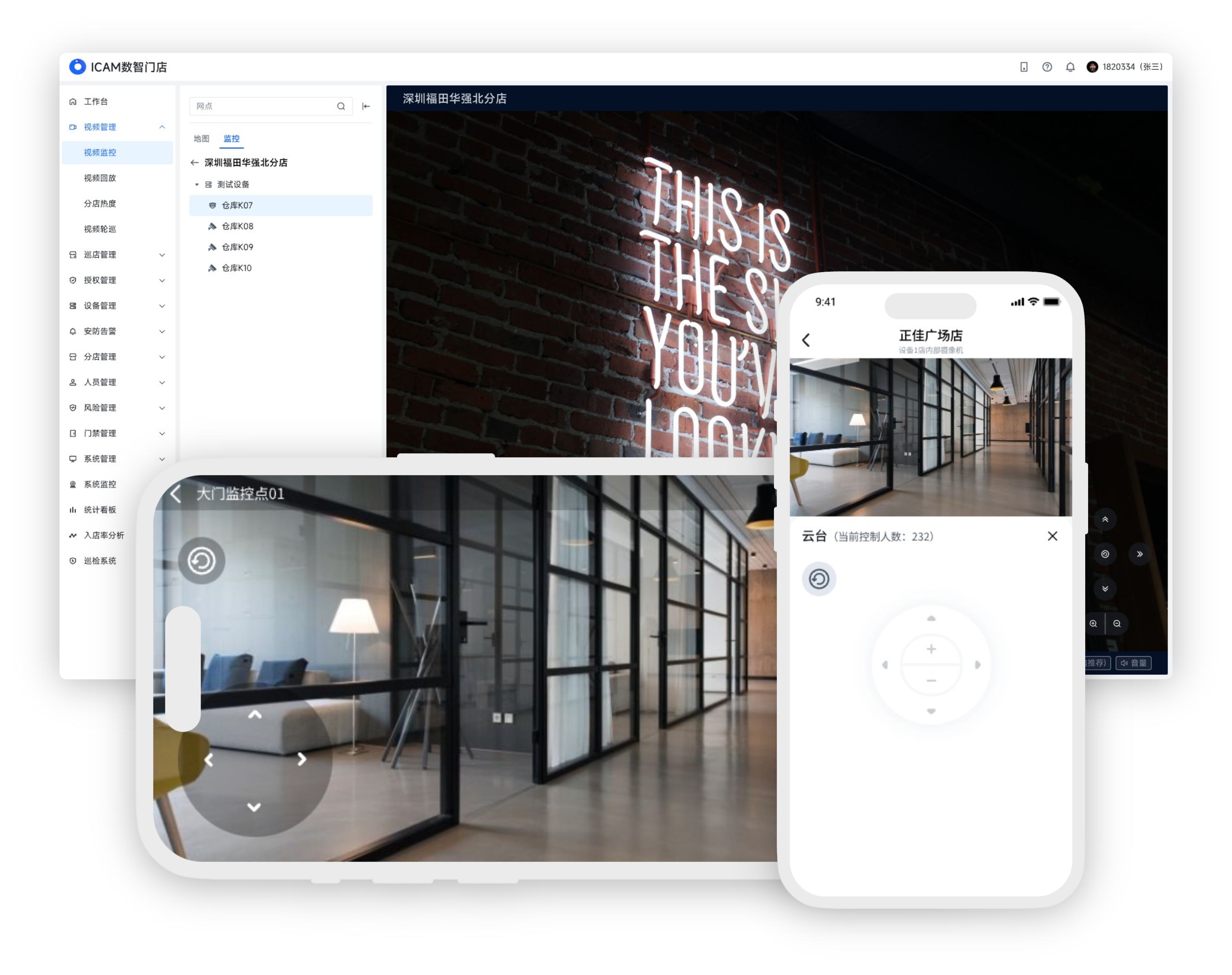

数智门店

数智园区

智慧机房

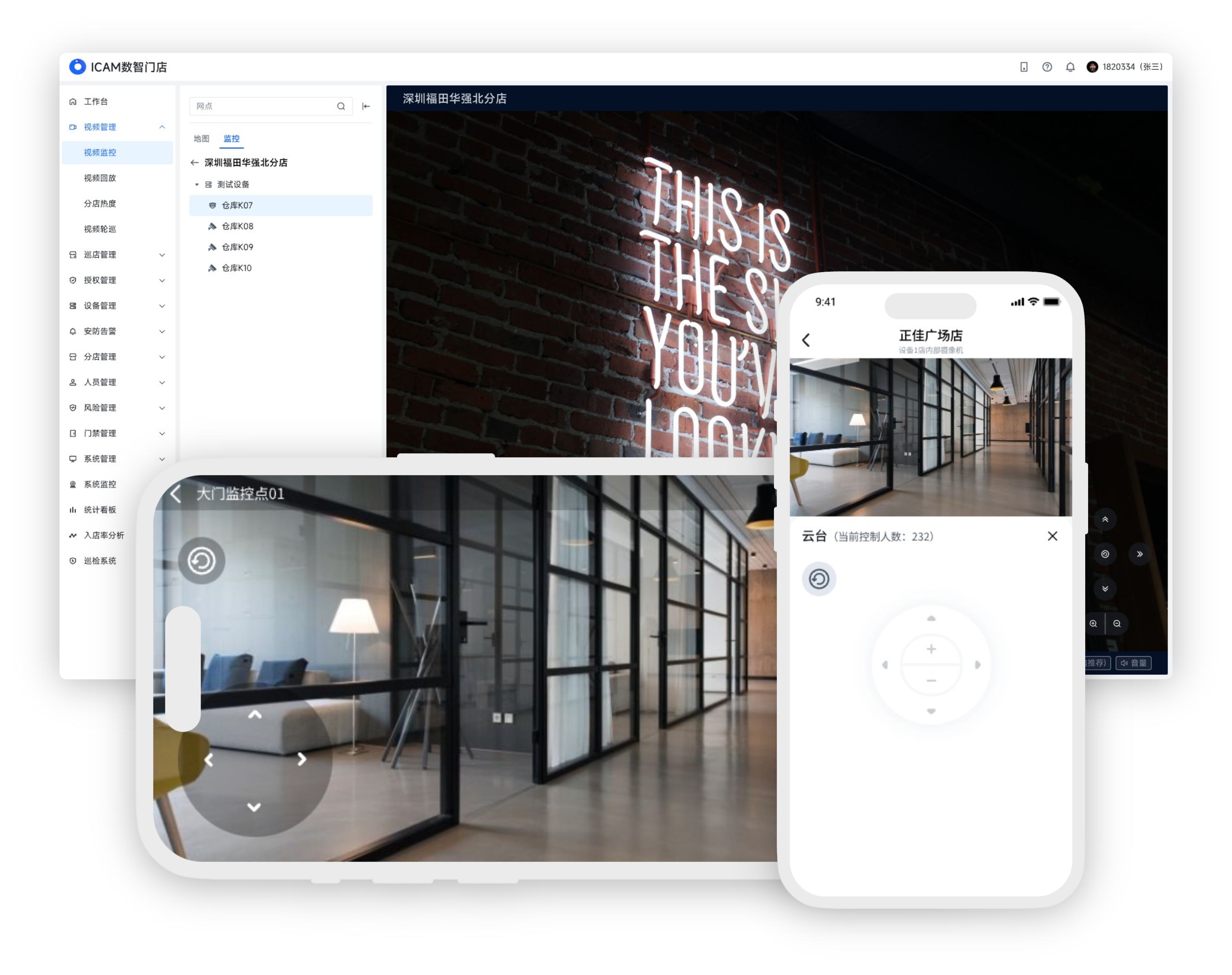

视频巡店

视频巡店、360°云台智控,分时段查看视频回放,品牌可自定义巡店考核标准、线上线下结合巡店打分

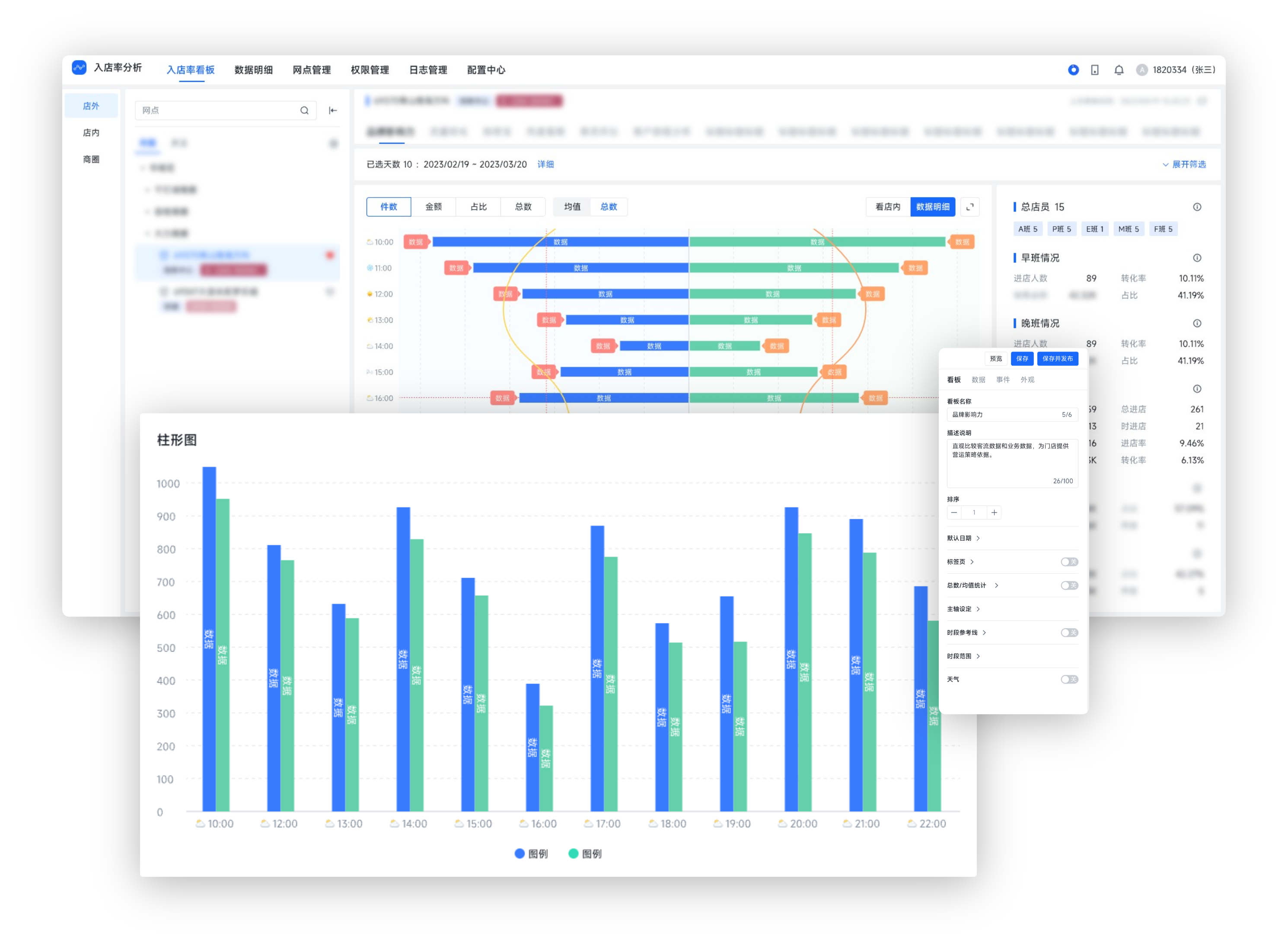

入店率分析

基于人、货、场进行分析,数据明细实时更新,定制可视化图表,结合业务数据制定门店营运策略

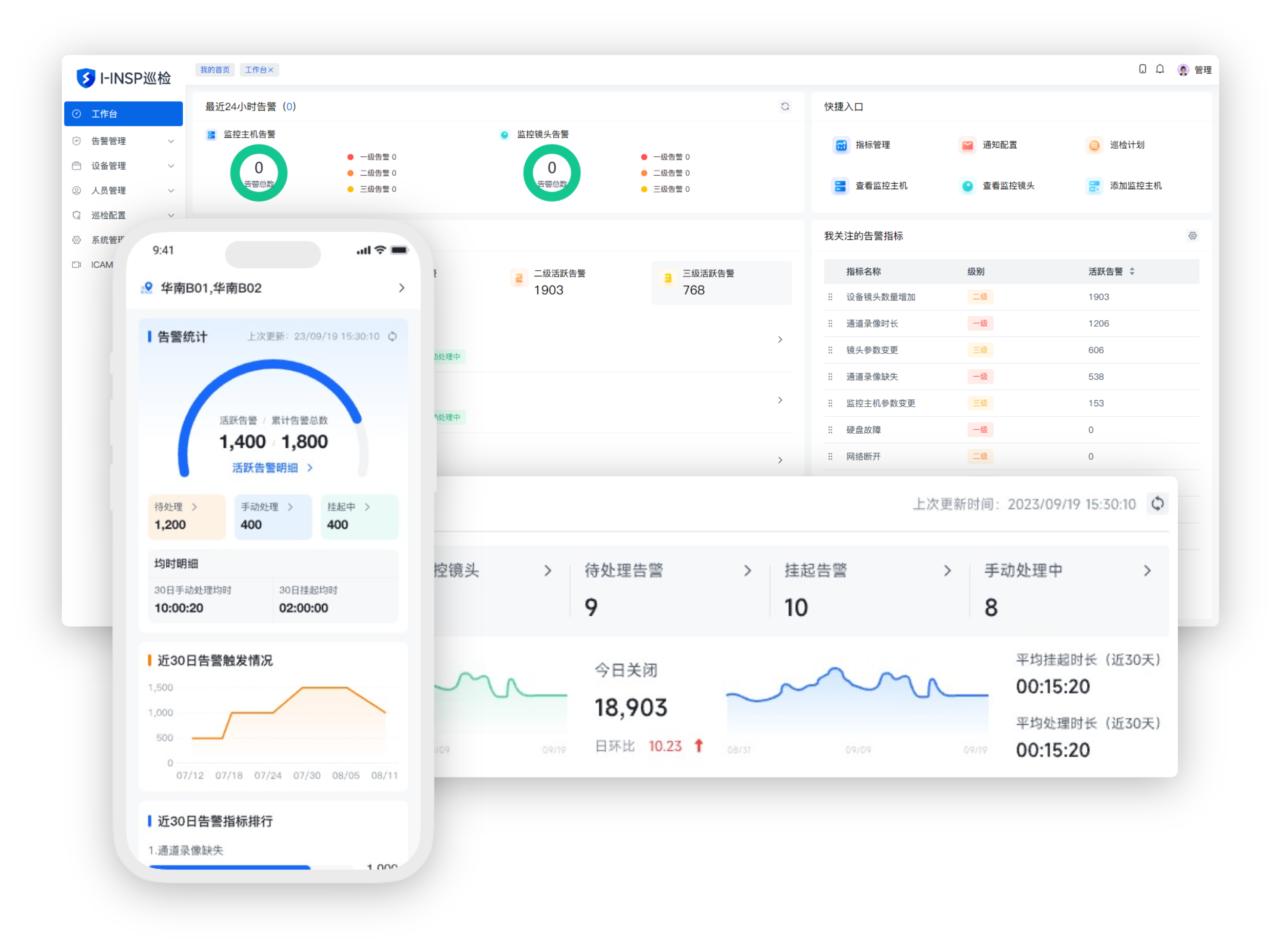

设备巡检

提供设备接入、巡检、运维等一站式物联网接入能力,后台实时告警,可进行可视化统计,高效保持设备运作

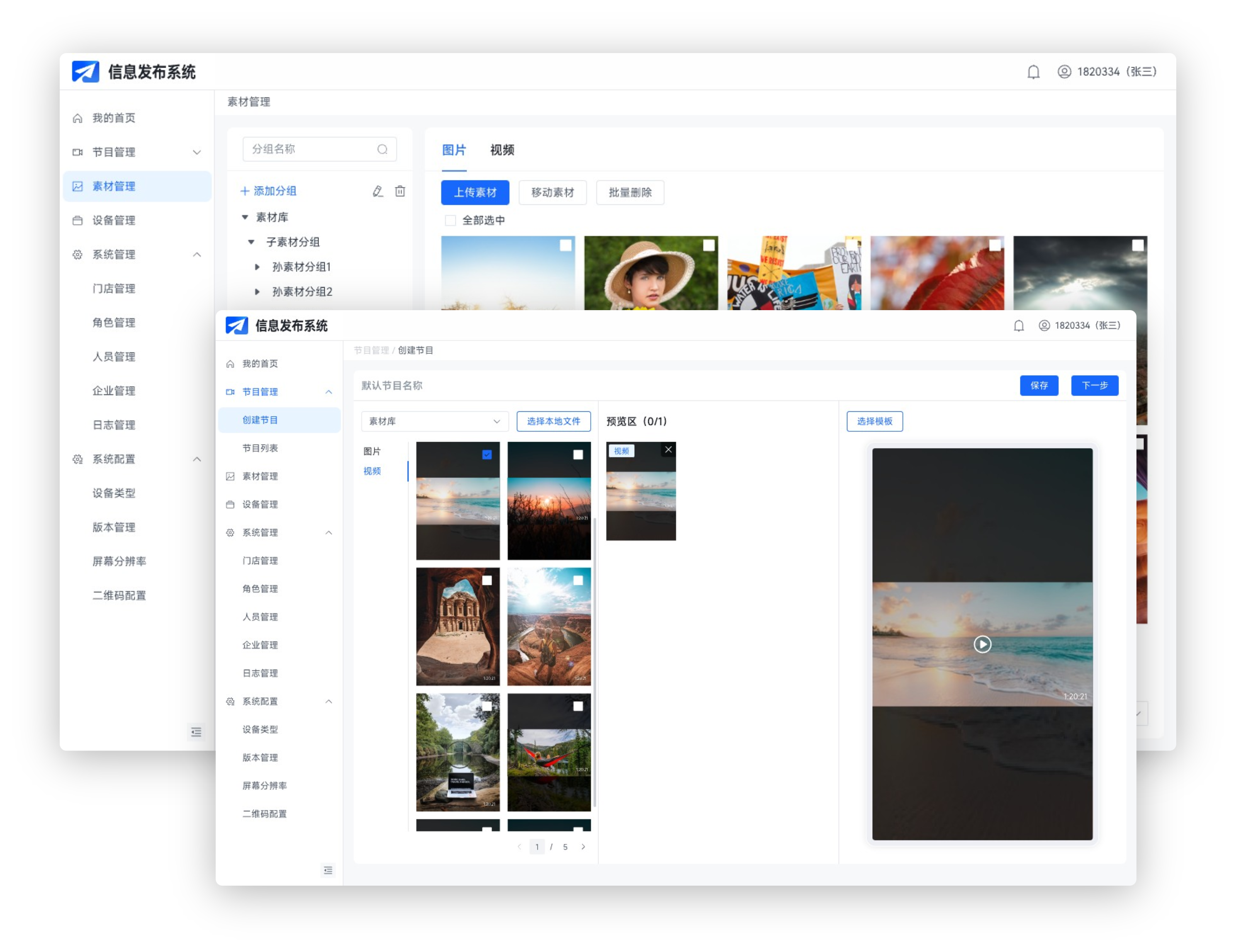

信息发布

总部统一管控设备,丰富宣传素材展示方式,帮助品牌加速推广落地,助力品牌市场营销

视频巡店

视频巡店、360°云台智控,分时段查看视频回放,品牌可自定义巡店考核标准、线上线下结合巡店打分

入店率分析

基于人、货、场进行分析,数据明细实时更新,定制可视化图表,结合业务数据制定门店营运策略

设备巡检

提供设备接入、巡检、运维等一站式物联网接入能力,后台实时告警,可进行可视化统计,高效保持设备运作

信息发布

总部统一管控设备,丰富宣传素材展示方式,帮助品牌加速推广落地,助力品牌市场营销

350vip葡京新集团——为各行业用户定制软硬件一体数字化管理解决方案!